Running a business often means managing cash flow challenges. One solution I’ve found particularly helpful is fast invoice factoring. It provides quick access to funds that would otherwise be tied up in unpaid invoices. If you’re dealing with slow-paying clients and can’t wait for 30 or 60 days to get paid, fast invoice factoring can be a game-changer.

Instead of waiting, I sell my invoices to a factoring company. In return, they give me most of the money upfront. This approach helps me keep my business running smoothly without taking on more debt.

What Is Fast Invoice Factoring?

Fast invoice factoring is a financial service where businesses sell their outstanding invoices to a factoring company for immediate cash. It differs from a loan because it doesn’t add liabilities to my balance sheet. I get the money I’ve already earned—just quicker.

The factoring company usually pays me 80–90% of the invoice value right away. They collect payment from the client, and once they get the full amount, they send me the remaining balance minus their fee.

Why I Use Fast Invoice Factoring

Cash flow is the lifeblood of any business. When I was just starting out, I faced delays in receiving payments from customers. These delays made it tough to pay employees, buy supplies, and grow my business. Fast invoice factoring provided a reliable solution.

I no longer had to wait months to receive payment. This freed up my capital and allowed me to take on new projects with confidence.

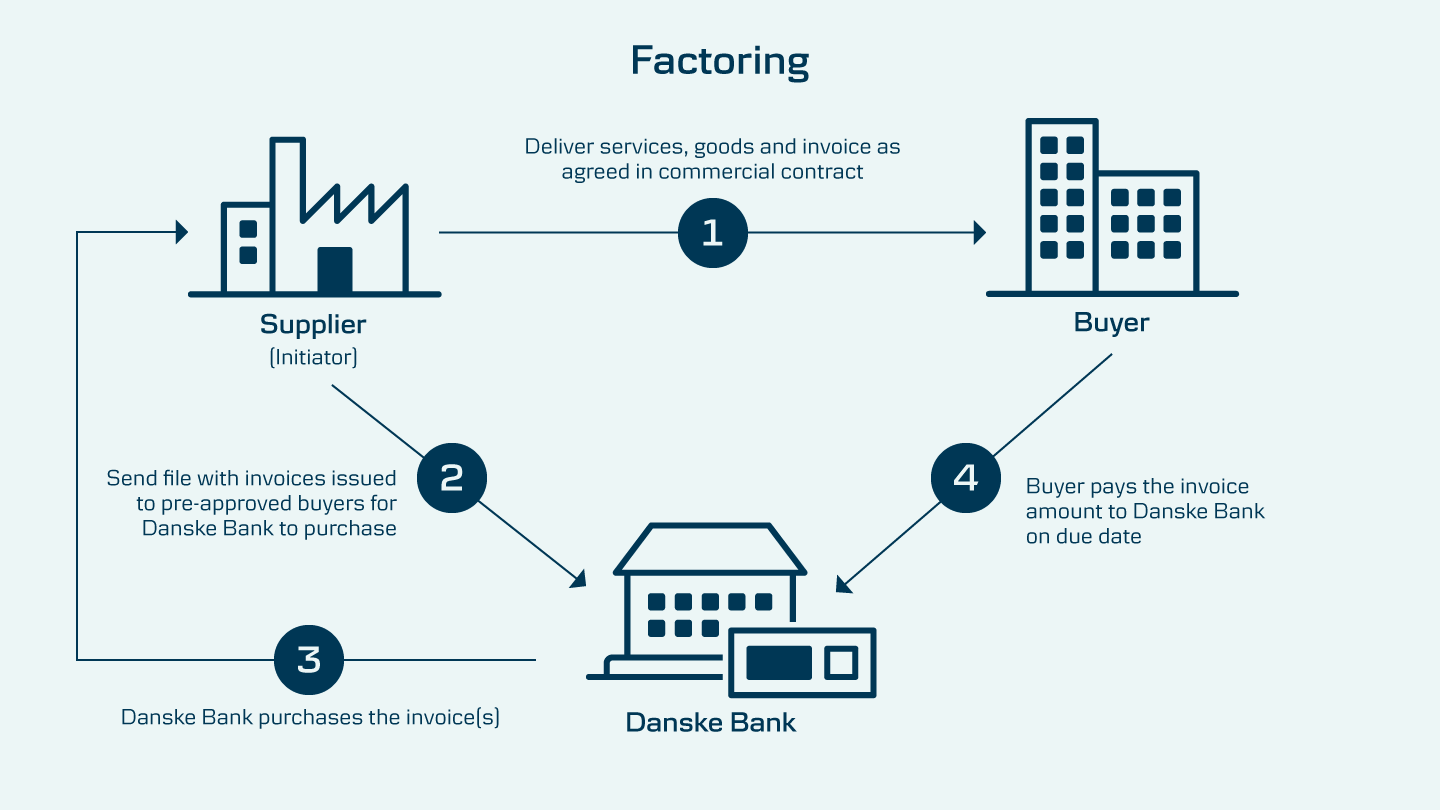

How Fast Invoice Factoring Works

Understanding how fast invoice factoring works helped me make informed financial decisions. Here’s the basic process:

-

I submit my unpaid invoices to a factoring company.

-

They verify the invoices and check my customers’ creditworthiness.

-

Once approved, I receive a cash advance—usually within 24 to 48 hours.

-

The factoring company collects the payment from my clients.

-

After collecting full payment, they send me the remaining amount, minus a fee.

This method is fast, simple, and requires less paperwork than traditional financing.

Types of Businesses That Benefit from Fast Invoice Factoring

I’ve noticed that fast invoice factoring is especially helpful for industries with long payment cycles. These include:

-

Trucking and logistics

-

Staffing agencies

-

Manufacturing

-

Construction

-

Marketing and creative services

If you’re in one of these industries and struggling with cash flow, this could be the right solution for you too.

Pros and Cons of Fast Invoice Factoring

Before I committed, I weighed the pros and cons of fast invoice factoring. Here’s what I found:

Pros

-

Immediate access to working capital

-

No debt involved

-

Easy qualification based on client credit

-

Supports business growth

Cons

-

It can be expensive due to factoring fees

-

Not all invoices may qualify

-

Clients interact directly with the factoring company

Understanding both sides helped me decide if this financial tool fit my business goals.

Choosing the Right Factoring Company

When selecting a provider, I considered several factors. The best fast invoice factoring companies offer:

-

Transparent fee structures

-

Fast approval and funding

-

Good customer support

-

Industry experience

I looked at online reviews and talked to other business owners before making a choice. This saved me from dealing with hidden fees and poor service.

How Much Does Fast Invoice Factoring Cost?

Cost was one of my biggest concerns. Most factoring companies charge a fee ranging from 1% to 5% of the invoice value. The exact cost depends on factors like:

-

Invoice amount

-

Payment terms

-

Customer creditworthiness

Some companies offer flat fees, while others use tiered pricing based on how quickly clients pay. I always review the contract thoroughly to understand all costs involved.

The Application Process for Fast Invoice Factoring

Applying was easier than I thought. The factoring company asked for:

-

Business financial statements

-

A list of customers

-

Copies of unpaid invoices

Most companies now let me apply online. I uploaded my documents and received a decision within a day. Once approved, I got funds transferred to my bank account within 24 hours.

Differences Between Fast Invoice Factoring and Traditional Loans

At first, I considered a bank loan. But fast invoice factoring was faster and didn’t require collateral. Here’s how they differ:

| Feature | Fast Invoice Factoring | Traditional Loan |

|---|---|---|

| Approval Time | 1–2 days | 1–4 weeks |

| Based On | Client credit | Business credit |

| Repayment | None (factoring company collects) | Monthly payments |

| Collateral | Not required | Often required |

These differences made factoring a more attractive choice for my needs.

Common Myths About Fast Invoice Factoring

I’ve heard many misconceptions, so I want to set the record straight:

-

Myth: It’s only for struggling businesses. Fact: Many growing businesses use it to fund expansion.

-

Myth: It’s a loan. Fact: It’s the sale of an asset (your invoice).

-

Myth: Clients will think you’re in trouble. Fact: Professional factoring companies maintain your reputation.

Clearing up these myths helped me feel more confident in my decision.

How Fast Invoice Factoring Helps in Emergencies

During a cash crunch, fast invoice factoring saved my business. I had unpaid invoices worth thousands but couldn’t access that money. Instead of taking a loan or delaying payroll, I factored the invoices and received funds quickly.

This gave me the breathing room I needed to stabilize and move forward without financial stress.

Building Long-Term Cash Flow Strategies

While fast invoice factoring is helpful, I also built long-term cash flow plans. These include:

-

Invoicing promptly

-

Offering early payment discounts

-

Monitoring accounts receivable

-

Setting clear payment terms

Using factoring along with these strategies keeps my business financially healthy.

Integrating Fast Invoice Factoring into My Business Model

I didn’t rely on factoring for every invoice. Instead, I used it strategically—especially during busy seasons or when onboarding new clients. This helped me grow steadily without overextending my resources.

Factoring became part of my overall financial toolkit, not a crutch.

The Future of Fast Invoice Factoring

As more businesses embrace digital solutions, fast invoice factoring is evolving. Many providers now offer:

-

Real-time invoice tracking

-

AI-based credit risk analysis

-

Integrated accounting tools

These features make the process even faster and more reliable. I see factoring becoming a common choice for small and medium-sized businesses in the coming years.

Real-Life Success Stories

Talking to other business owners helped me realize I wasn’t alone. One friend in the logistics industry grew his fleet using fast invoice factoring. Another in staffing used it to cover weekly payroll without dipping into reserves.

These stories encouraged me to take the leap—and I’ve never looked back.

How to Get Started with Fast Invoice Factoring

Getting started is simple. Here’s how I did it:

-

Researched factoring companies online

-

Requested quotes from three providers

-

Compared fees, funding time, and customer reviews

-

Submitted my application and invoices

-

Received funds within 24 hours

If you’re ready to take control of your cash flow, you can explore this factoring service as a good starting point.

Conclusion: Why I Recommend Fast Invoice Factoring

In my experience, fast invoice factoring is more than just a financing tool—it’s a growth enabler. It helped me stay ahead of expenses, take on more work, and keep my team paid without stress. I recommend it to any business owner facing cash flow gaps.

When used wisely, fast invoice factoring can support steady growth without long-term debt. It’s not about quick fixes—it’s about smart financial management.

Reference

Fundbox – What Is Invoice Factoring?