As someone who closely watches the economy, the Federal Reserve Rate Hike Analysis July 2025 has been top of mind this month. With the markets on edge and inflation showing unexpected resilience, I dove deep into the Fed’s latest decision. In this post, I’ll break down what the rate hike means, why it happened, and […]

Month: July 2025

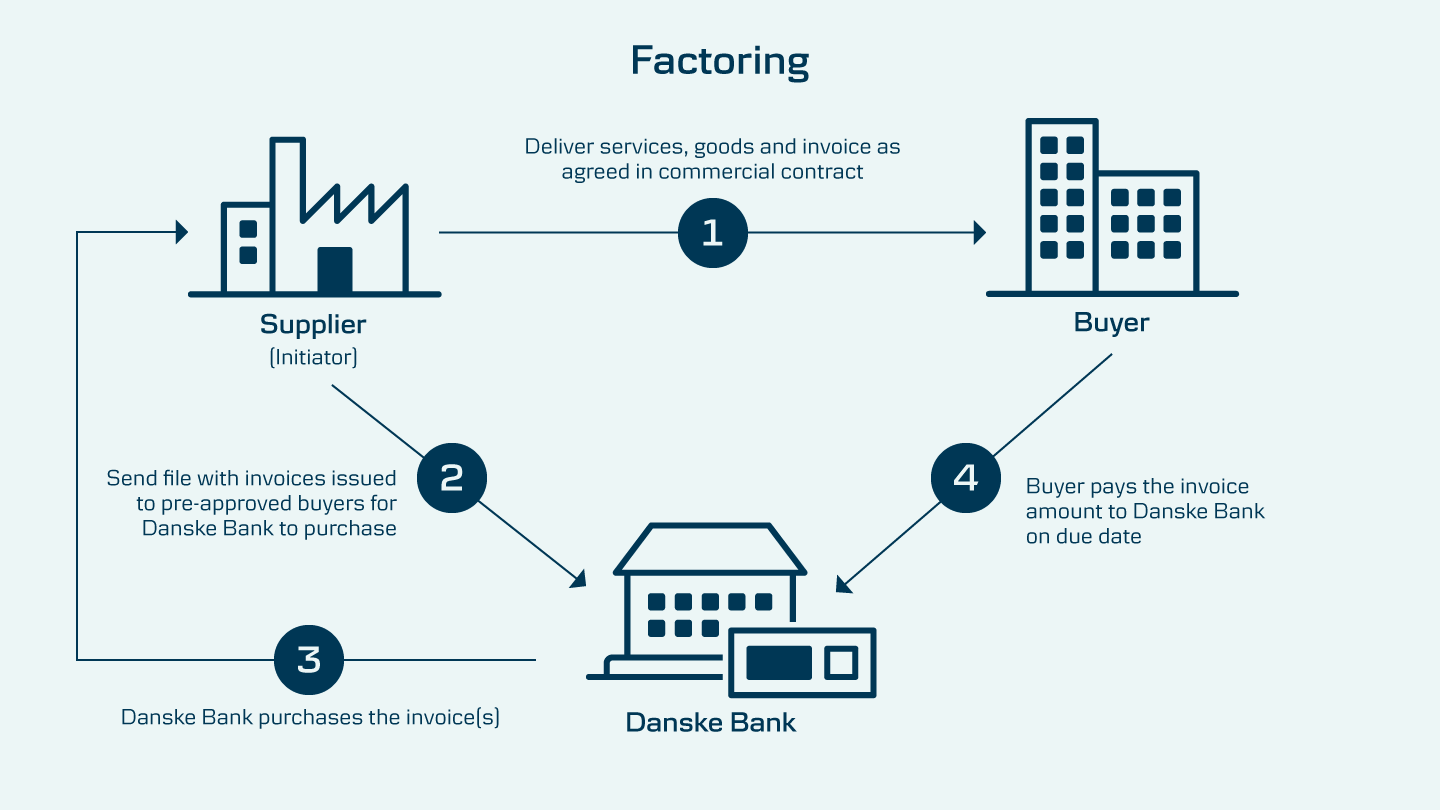

Introduction to Fast Invoice Factoring

Running a business often means managing cash flow challenges. One solution I’ve found particularly helpful is fast invoice factoring. It provides quick access to funds that would otherwise be tied up in unpaid invoices. If you’re dealing with slow-paying clients and can’t wait for 30 or 60 days to get paid, fast invoice factoring can […]

Introduction to Invoice Factoring for Staffing Companies

As the owner of a staffing company, I know firsthand how challenging it is to maintain cash flow while waiting on client payments. That’s where invoice factoring for staffing companies becomes a lifesaver. It’s not just about getting money faster—it’s about keeping your business running smoothly and growing without financial bottlenecks. In this article, I’ll […]

Structured Settlement Loan: A Complete Guide to Unlocking Your Funds

What Is a Structured Settlement Loan? When I first heard about a structured settlement loan, I assumed it worked just like any other traditional loan. But I soon learned it’s a bit more nuanced. A structured settlement is a financial agreement where someone receives periodic payments after winning a lawsuit or insurance claim. It’s meant […]

Company Credit Line: A Complete Guide to Business Funding

Running a business means managing cash flow smartly. One of the best tools I’ve found for keeping things afloat and growing steadily is a company credit line. It’s not just a financial backup; it’s a flexible way to handle operations, unexpected expenses, and new opportunities. Whether you’re a startup or a growing enterprise, understanding how […]